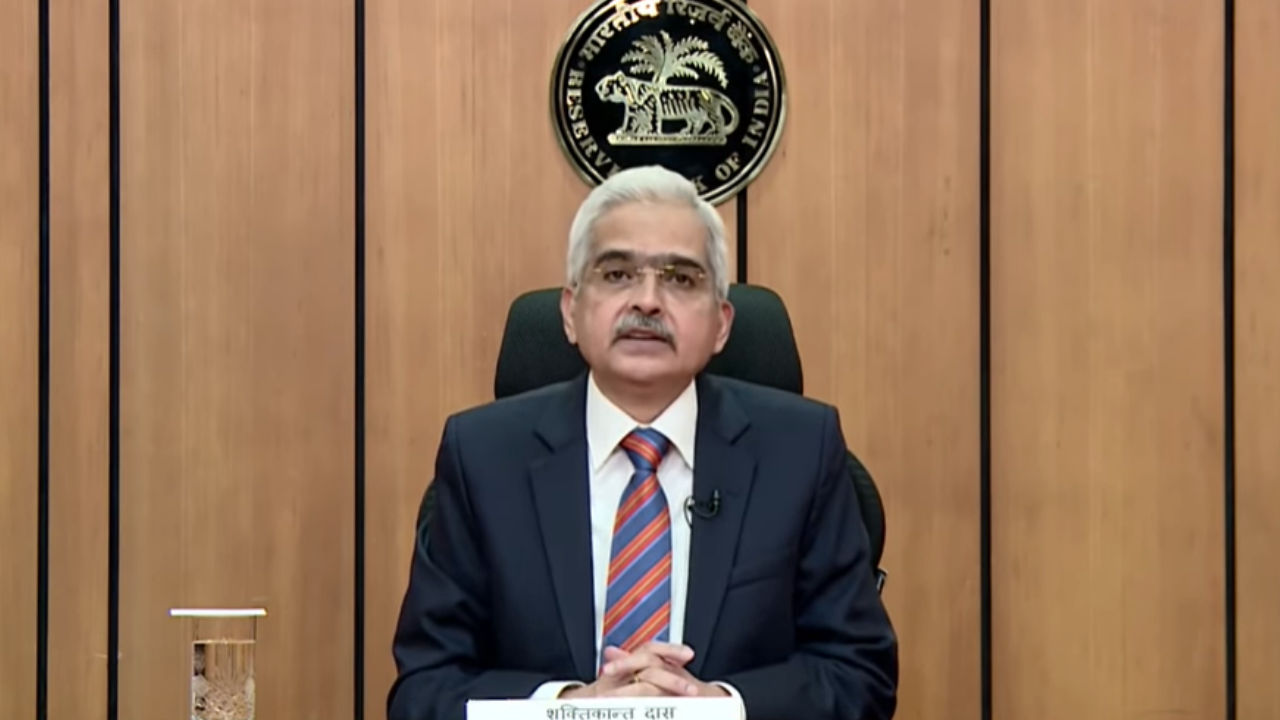

RBI Imposed Penalty on SBI: Action against State Bank of India; RBI imposes Rs 2 crore penalty on state bank of India

- The Reserve Bank took action against SBI.

- Violation of rules regarding remuneration paid to employees

- Show cause notice was sent by RBI

The Reserve Bank of India (RBI) has slapped a fine of Rs 2 crore on the State Bank of India, the country’s largest bank. The Reserve Bank of India (RBI) has taken action against SBI for violating the rules on remuneration paid to employees. SBI has also been directed to submit details of how the commission was paid to the employees.

The RBI had conducted statutory examinations on March 31, 2017, and March 31, 2018. It examined the State Bank’s financial report and the risk report. It found that SBI had not paid commission to its employees in the form of an honorarium. In a press release issued by the Reserve Bank of India, the Reserve Bank of India (RBI) has imposed a fine of Rs. It is said.

The RBI had issued a show-cause notice to SBI. State Bank of India (SBI) was issued a show-cause notice as to why no penalty should be levied for violating RBI directives and provisions of the Banking Act. The RBI decided to take punitive action after SBI did not respond satisfactorily. The RBI imposed a fine of Rs 2 crore on the State Bank of India for violating the rules, showing that the law is the same for all.

The difference was found in the Central Bank of India

Meanwhile, another public sector bank, the Reserve Bank, has found discrepancies in bank records. The Central Bank of India’s provision for Rs 519 crore in FY20 has been questioned. The Reserve Bank of India (RBI) found discrepancies in the central bank’s financial performance in 2020 in terms of non-performing loans, losses, and provisions. As per the balance sheet submitted by the Central Bank, as of March 31, 2020, the bank’s outstanding loans stood at Rs 32,589.08 crore. According to the RBI, the NPLs stood at Rs 32,678.08 crore. A difference of Rs 89 crore has also been found in non-performing loans. Currently, there are restrictions on the Central Bank of India under the RBI’s Prompt Corrective Action Framework.